Unlocking Opportunities: A Comprehensive Overview to E2 Visa Financial Investment

The E2 Visa offers a distinct chance for foreign capitalists looking for to develop a footing in the U.S. market. Comprehending the ins and outs of eligibility requirements, financial investment kinds, and the required components of an engaging service plan is vital for an effective application. Potential challenges and difficulties can arise during the process, making it vital to approach this journey with enlightened techniques. As we discover the necessary elements of E2 Visa financial investment, one must consider what truly distinguishes effective applications from the remainder.

Understanding the E2 Visa

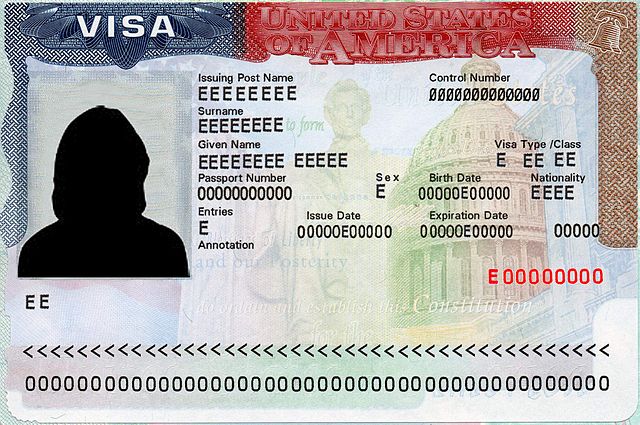

The E2 Visa serves as a necessary entrance for international investors seeking to develop or take care of a service in the USA. This non-immigrant visa is especially developed for nationals of nations that keep a treaty of business and navigating with the united state. It enables eligible people to spend a substantial amount of funding in a U.S.-based venture, thereby helping with financial development and work creation.

The E2 Visa is particularly appealing due to its adaptability regarding investment types. Financiers can involve in different business industries, from innovation start-ups to friendliness and retail endeavors. Additionally, it allows for family inclusion, allowing the financier's spouse and kids to accompany them to the U.S., giving them specific rights, including the ability to attend school and, when it comes to the partner, the chance to look for work authorization.

In addition, the E2 Visa does not have actually a specified limit on the number of expansions, gave the organization continues to be functional and meets the visa requirements. This attribute permits financiers to preserve a lasting visibility in the U.S., fostering both individual and expert development.

Eligibility Needs

International financiers must fulfill certain eligibility requirements to get the E2 Visa. The financier must be a nationwide of a country that has a certifying treaty with the United States. This treaty should enable financial investment and the issuance of E2 Visas. The financier must likewise hold at the very least 50% possession in the venture or possess operational control through a supervisory setting.

Additionally, the financial investment should be significant, indicating it should be sufficient to assure the successful procedure of business - E2 Visa Requirements. The investor needs to show that the funds utilized for the financial investment are either their own or lawfully gotten. The business needs to be an actual and operating business, not a marginal one aimed only at generating revenue for the financier.

The investor needs to also intend to create and direct the venture, suggesting an authentic dedication to the service. The capitalist's purpose to return to their home nation after the E2 Visa runs out is essential, as the E2 Visa is a non-immigrant visa. Meeting these eligibility requirements is important for a successful application for the E2 Visa.

Investment Amount and Types

When pursuing an E2 visa, comprehending the minimum investment requirements is important for compliance and success. Additionally, recognizing the various kinds of qualified financial investments can greatly impact your organization approach. This area will certainly detail both the monetary thresholds and acceptable investment methods to lead prospective candidates.

Minimum Investment Needs

Minimum financial investment needs for the E2 visa differ based upon the nature of the organization and its place. Normally, the financial investment needs to be considerable in regard to the total price of buying or establishing the venture. While no main minimum investment quantity is stated by the U.S. federal government, a typically accepted standard is around $100,000. However, for certain organizations, especially those in lower-cost sectors or areas, investments as reduced as $50,000 may be taken into consideration substantial.

The financial investment amount must suffice to assure the successful procedure of the service. Aspects influencing the called for financial investment consist of the industry type, functional expenses, and the expected earnings potential. For circumstances, a retail or dining establishment company might demand a higher investment to cover supply, leasehold improvements, and worker incomes, whereas a consulting firm might need much less ahead of time capital.

Importantly, the funds should go to risk, implying they should be irrevocably dedicated to business and can not be withdrawn. Capitalists must also be prepared to offer in-depth economic documents to show the legitimacy and source of the funds, which is important for the E2 visa process.

Eligible Financial Investment Kinds

Recognizing the kinds of financial investments qualified for the E2 visa is vital for prospective investors. This visa category enables foreign nationals to buy a united state service, offered that the investment is substantial and meets certain criteria. The investment amount is not fixed but must be proportional to the total price of acquiring or beginning business. Normally, financial investments range from $100,000 to $200,000, depending upon the nature of the venture.

Eligible investment kinds consist of both concrete and abstract assets. Substantial assets encompass realty, tools, and inventory, which are important for running the business. Abstract assets, such as trademarks, patents, or licenses, can likewise qualify if they demonstrate business's feasibility and potential.

The financial investment should be at danger, meaning that the funds must undergo loss in case of business failure. In addition, business should be energetic and not low, indicating that it should create enough income to sustain the financier and their family members. Comprehending these investment kinds will much better furnish candidates in steering through the E2 visa process successfully.

Service Plan Essentials

A well-structured service plan is necessary for E2 visa applicants, as it works as a roadmap for the suggested enterprise and an influential device for demonstrating the practicality of the investment - E2 Visa Requirements. The organization plan ought to begin with an exec summary that succinctly outlines business concept, objectives, and funding demands

Next, an in-depth market analysis is important, showcasing an understanding of the target audience, competitors, and prospective consumer demographics. This section can highlight trends that might impact the organization favorably.

The functional plan should lay out business framework, area, and daily operations, including staffing and administration duties. It is important to information the product and services used, emphasizing their special selling points and affordable advantages.

Financial projections, consisting of income statements, capital forecasts, and break-even analysis, are essential components that show the potential for profitability and sustainability. Lastly, the plan must identify potential threats and overview techniques for minimizing them.

Application Process Actions

The application process for an E2 visa entails several essential steps that need to be diligently followed to guarantee success. This section will describe the qualification needs, provide a comprehensive file preparation checklist, and offer a summary of the interview process. Understanding these components is important for possible investors wanting to navigate the complexities of obtaining an E2 visa.

Qualification Requirements Explained

Maneuvering the intricacies of E2 visa qualification requires careful interest to specific investment requirements and application processes. To get approved for an E2 visa, applicants should be nationals of a nation that has a pertinent treaty with the USA. This fundamental requirement develops the first structure for eligibility.

The investment must be substantial, typically taken a considerable amount of capital relative to the complete cost of the business. While the exact number may vary, it commonly ranges from $100,000 to $200,000. In addition, the financial investment must be at threat, indicating funds need to be committed and subject to loss, instead than merely held in a checking account.

In addition, business should be an authentic enterprise, implying it is genuine, energetic, and operating, creating income sufficient to support the capitalist and their family members. Applicants ought to likewise show their intent to create and direct the enterprise, highlighting their duty in its management.

Document Preparation Checklist

When beginning the application process for an E2 visa, in-depth file prep work is necessary to assure a smooth and effective submission. The initial step is to put together a detailed business plan that outlines your investment, the nature of business, and market analysis. This document should clearly highlight just how your venture will certainly create earnings and produce jobs.

Next, collect proof of your mutual fund, including bank statements, evidence of possession ownership, and any economic documents that confirm the source of your funds. Additionally, prepare documents that show your service's legal standing, such as incorporation documents, running contracts, and any type of necessary licenses or permits.

Individual records are likewise essential; include your visa, a recent photo, and proof of your credentials and experience in the appropriate area. It's advisable to include your return to or curriculum vitae.

Validate that you have finished the necessary forms, such as the DS-160 and DS-156E, as well as the ideal filing costs. Organizing these papers meticulously will not just improve your application process yet likewise boost the probability of approval.

Interview Process Review

After gathering and arranging the required documents, the next action in the E2 visa process involves planning for the interview. The interview typically happens at an U.S. consulate or consular office and acts as an important assessment of your application. It is necessary to arrange this appointment well beforehand, as delay times can vary significantly.

Throughout the meeting, a consular officer will review your application, verify your investment strategies, and analyze your qualifications. Anticipate to discuss your organization design, financial forecasts, and the resource of your financial investment funds. Being prepared to answer concerns clearly and with confidence is essential, as this can considerably affect the outcome of your application.

Before the interview, practice your reactions and expect prospective concerns. Bring all initial records and duplicates, including your organization plan, income tax return, and proof of investment. Gown skillfully to communicate severity concerning your application.

Adhering to the meeting, the consular police officer might accept the visa, demand added documents, or issue a rejection. Understanding this process allows you to browse the E2 visa better and boosts your chances of an effective outcome.

Typical Difficulties and Solutions

Navigating the E2 visa process provides a number of common challenges that prospective capitalists have to resolve to improve their possibilities of success. One considerable hurdle is demonstrating that the financial investment is significant and in jeopardy. Financiers should provide detailed economic paperwork to illustrate the viability of their business version and assurance that their investment goes beyond the minimum needed threshold.

An additional difficulty depends on the need to develop a real and running venture. Financiers frequently have problem with specifying and presenting a thorough organization plan that describes functional strategies, market evaluation, and potential productivity. A well-structured plan is vital to showcase business's authenticity and its possible pop over to these guys economic impact.

In addition, passing through the intricacies of U.S. migration regulations can be frightening. Investors might encounter problems in recognizing the documentation required for the application process. Involving a skilled immigration lawyer can reduce this problem, ensuring that all documents is meticulously prepared and submitted.

Last but not least, cultural differences and language obstacles can restrain effective communication with united state authorities. Investors must consider seeking help from local experts who are acquainted with the subtleties of the American business atmosphere to assist in smoother communications

Tips for Effective Authorization

To attain effective authorization for an E2 visa, thorough preparation is vital. Beginning by extensively understanding the eligibility needs, including the requirement of a considerable financial investment in a united state organization. It's vital to demonstrate that your investment is adequate to ensure the service's stability and development.

Assemble extensive documentation that outlines your business plan, consisting of market evaluation, economic estimates, and functional methods. This strategy needs to plainly express just how business will certainly produce tasks for U.S. workers, as work production is a key consider the authorization process.

Involving a qualified immigration lawyer can substantially improve your application. They can supply very useful advice on steering with the complexities of the E2 visa process and validate that all documentation is completely completed and sent in a prompt manner.

Additionally, plan for the consular meeting by practicing solution to possible concerns regarding your financial investment, service plans, and connections to your home nation. Demonstrating a clear purpose to return home after your visa ends can also reinforce your situation. By adhering to these ideas, you enhance your chances of getting a successful E2 visa authorization, opening doors to brand-new chances in the United States.

Often Asked Questions

Can My Family Members Accompany Me on the E2 Visa?

Yes, your household can accompany you on an E2 visa. Partners and unmarried youngsters under 21 are eligible for acquired E2 visas, allowing them to live and research in the USA during your investment duration.

How Lengthy Does the E2 Visa Last?

The E2 visa generally lasts for 2 years, with the possibility of uncertain renewals, supplied the investment venture remains functional and meets the visa demands. Expansions are granted based upon ongoing eligibility and service activity.

Can I Change Organizations While on an E2 Visa?

Yes, you can switch services while on an E2 visa, provided the new service fulfills all investment and operational demands. It's suggested to seek advice from an immigration lawyer to assure compliance with visa policies during the transition.

Exists an Optimum Variety Of E2 Visa Renewals?

There is no main limit on the number of E2 visa renewals; nevertheless, each renewal has to show ongoing business practicality and compliance with visa demands. Constant adherence to laws is essential for successful renewals.

What Happens if My Business Fails While on an E2 Visa?

If your company stops working while on an E2 visa, you may risk losing your visa status. It is necessary to discover different options, such as shifting to another visa or seeking lawful suggestions for correct advice.

In addition, the E2 Visa does not have actually a specified restriction on the number of expansions, supplied the company stays operational and fulfills the visa needs. The financier's objective to return to their home country after the E2 Visa runs out is necessary, as the E2 Visa is a non-immigrant visa. The E2 visa commonly lasts for 2 years, with the possibility of uncertain revivals, offered the financial investment business remains functional and satisfies the visa requirements - American E2 Visa. There is no main limit on the number of E2 visa revivals; nevertheless, each renewal has to show continuous business stability and compliance with visa requirements. If your service stops working while on an E2 visa, you might run the risk of losing your visa standing